. The date (audit working paper prepared). Title (subject matter). Assignment/file reference. Clear cross-reference to linked documents or working papers (either on a hard copy file or electronically). The initials/signature of the internal auditor who prepared the working paper (or electronic equivalent). Audit working papers are tool for accomplishing the purpose of audit. Audit working papers record evidence gathered by the auditor which will help him in arriving at his conclusions. Also they act as support for work accomplished. Working papers are tool for accomplishing the purpose of audit. Audit working papers serve four major purposes:A. They constitute a permanent record of the objectives and scope of the audit, as well as the work performed during the audit. Work papers organize and coordinate all phases of the audit.B. They contain the back-up material in support of the audit findings. By Maire Loughran. Part of your job as a staff associate in an auditing firm is to document your findings in working papers (also known as workpapers) and schedules. Workpapers summarize your audit actions, such as planning the audit. Schedules show what steps you take to reach a conclusion.

Working papers are an essential part of every audit for effectively planning the audit, providing a record of the evidence accumulated and the results of the tests, deciding the proper type of audit report, and reviewing the work of assistants. Let’s know the importance of audit working papers.

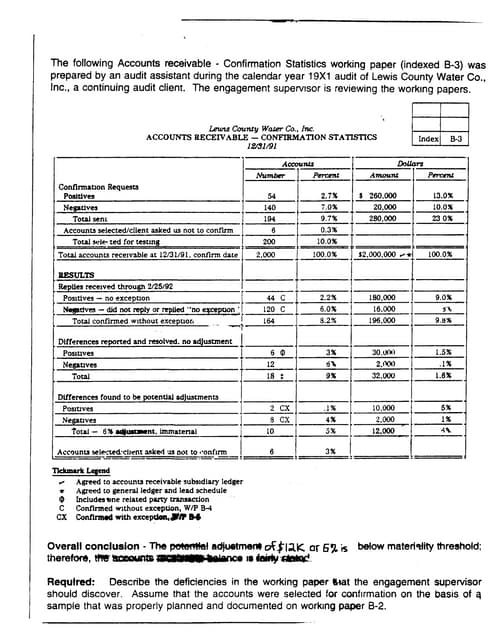

Audit Files And Working Papers Sample

CPA firms establish their own policies and approaches for working paper preparation to make sure that these objectives are met. High-quality CPA firms make sure that working papers are properly prepared and are appropriate for the circumstances in the audit. Working papers are important because:

Audit Working Papers Pdf

Importance of audit working papers

- Working papers assist in the planning and performance of the audit.

- Working papers are necessary for audit quality control purposes.

- Working papers provide assurance that the work delegated by the audit partner has been properly completed.

- Working papers provide evidence that an effective audit has been carried out.

- Working papers increase the economy, efficiency, and effectiveness of the audit.

- Working papers contain sufficiently detailed and up-to-date facts which justify the reasonableness of the auditor’s conclusions.

- Working papers retain a record of matters of continuing significance to future

- The preparation of the working papers is a means to give training to the audit clerks as to how to summarize the work done by them.

- The working papers enable the auditor to point out to the client the weakness of the internal control system in operation and inefficiency of the accountancy He may, therefore, be in a position to advise his client as to how to avoid such pitfalls.

- The working papers enable the auditor to prepare the report to be issued without much waste of time.

- He can know that his assistants had followed his instructions.

Working Papers Audit Training

You May Like Also: